Last Updated on November 26, 2020 by Emma

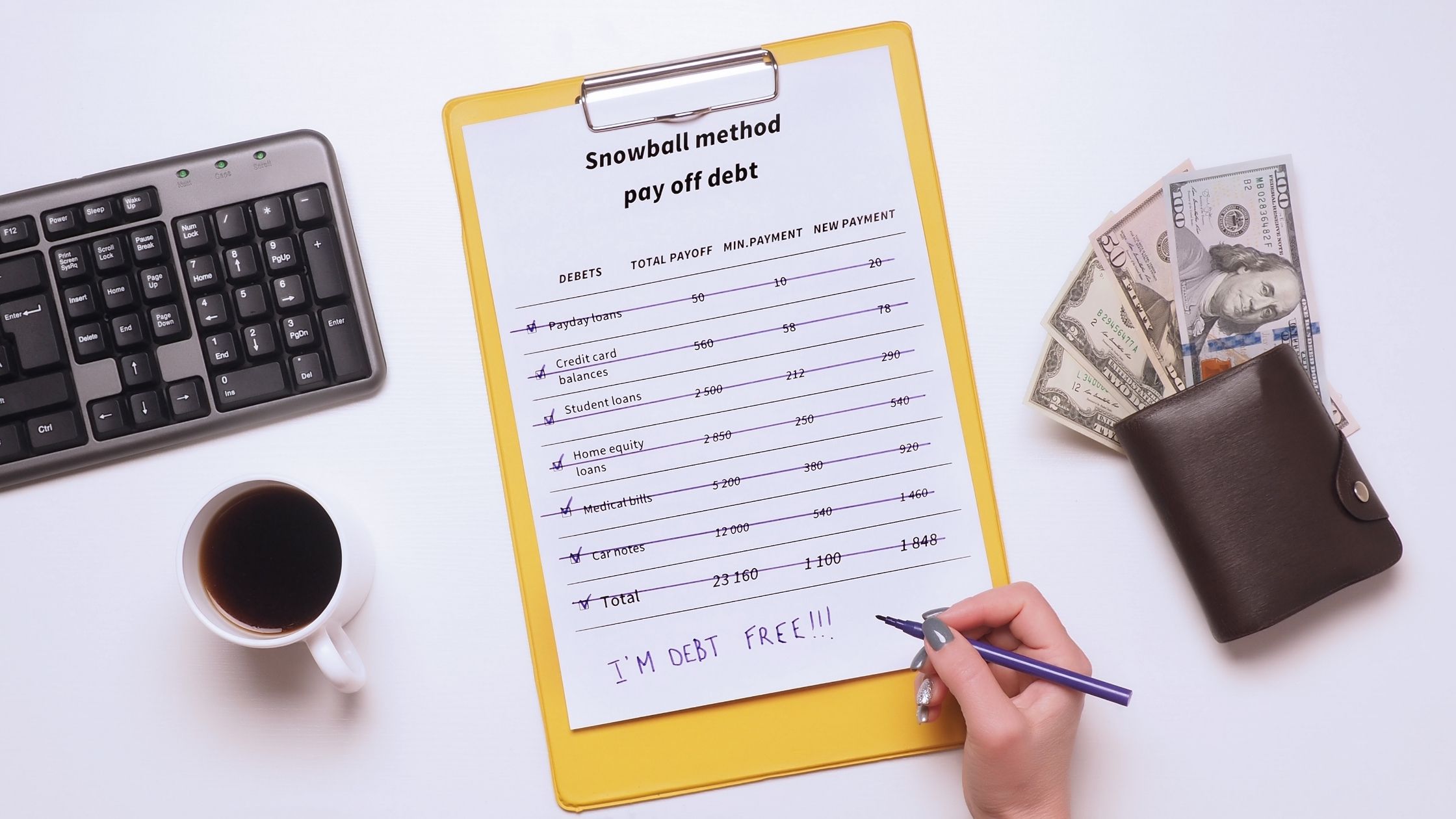

The debt snowball is a method of repaying debt that has received support from Dave Ramsey, a prominent personal finance expert based in America. It involves paying off your debts from smallest to largest to encourage more motivation to become debt-free. At the same time, you pay the minimum payments on your other debt to keep your accounts in good standing.

Let’s get your snowball rolling!

This post may contain affiliate links. If you decide to use them, my blog may earn a small commission at no additional cost to you, which helps to fund more helpful articles for you to enjoy. Find out more in my Affiliate Disclosure. Nothing in this article constitutes financial, or other, advice. These are my views and the results of years of research, testing and learning.

Table of Contents

How does the debt snowball method work?

The debt snowball method involves listing your debts by their balance size, rather than their interest rate. You then repay your debts one by one, from the smallest balance you owe, right up to the largest balance. While paying off your debts in order of size, you pay the minimum payments on your other debt accounts to keep them in good standing and avoid penalties.

The idea behind this method is that the motivation you receive from paying off the smallest balance quickly, inspires you to tackle the next one and then the next one.

What debts should I include in my debt snowball?

You should include any consumer debts, including:

- Car loan

- Credit cards

- Parking fines

- Store credit

- Personal loans

- In the US – student loans. In the UK, the student loan system is less expensive, and you repay it through your earnings, so some people choose not to include it within their debt snowball. Others decide they want to be completely debt-free and they include it.

For most people, their mortgage is typically their largest debt. Dave Ramsey recommends that you leave paying off that debt until you’ve paid off all of your consumer debts and then also saved up three to six months of your expenses in case of emergencies, such as a health issue or losing your job.

The benefits of the debt snowball method

The debt snowball methods works because you receive a motivational boost every time that you pay off a debt in full. Your first boost often comes quite quickly as you start by paying off your smallest debt balance.

By the time you come to pay off your biggest debt using the debt snowball, you’ll have built confidence from paying off numerous smaller debts first.

In Dave Ramsey’s experience, people tend to see more success with the debt snowball method than other debt management approaches because it’s easier to stick with the plan.

The downsides of the debt snowball method

The main downside of the debt snowball is that you can end up paying more in interest, than is the case with the debt avalanche method, which prioritises paying off your highest interest-bearing debts first. However, in general, more people find the debt snowball method works for them because they can stick with it for the time it takes to become consumer debt-free.

How should I prepare to pay off debt with the debt snowball method?

Before starting on your debt snowball, it’s wise to build up a pot of money for emergencies that enables you to cover an unexpected bill without adding to your debt balance. Most people aim to save around £1000 or $1000 for this purpose.

It’s also essential to create a monthly budget so that you can track precisely how much you earn and spend. For more guidance on how to create a budget, see How to do a Monthly Budget.

How can I pay off my debt snowball faster?

You have two main levers that enable you to achieve faster progress with your debts:

- Reducing your expenses. If you’d like inspiration for how to save money in everyday life, see Top Tips to Start Saving.

- Increasing your income. There are many ways to do this. If you have a job that allows you to work more hours in return for more money, you could do that. Alternatively, you could take on a part-time job or start a side hustle that allows you to earn money alongside your other responsibilities. For some inspiration on ways to earn extra money, see my articles on Best Side Hustles and Ways to Make Money Online from Home.

Keeping motivated as you make progress toward becoming debt-free

As you work to get out of debt, you will likely encounter some challenges and sacrifices that challenge you. The best way to stay motivated is to start with a clear reason why you want to get out of debt and what that will do for you and your family.

You could bring your motivations to life through a vision board – a collage of pictures of what you want to achieve, that you place somewhere that’s visible in your home. You could also have a visual tracker of your progress in paying down your debt with rewards along the way. For example, colouring in a square on a picture each time you pay off a specific amount of extra money. Then at certain milestones reward yourself with something that you enjoy that doesn’t necessarily cost money, such as a trip to a national park.

What happens after the debt snowball?

First, you should take a moment to celebrate all of your progress! Becoming consumer debt-free is a huge achievement.

The next steps, according to Dave Ramsey’s baby steps are to:

- Save up three to six months of household expenses in a fully-funded emergency fund.

- Then complete the next three steps together: put 15% of your income towards retirement, pay off your mortgage (and become entirely debt-free), and put money towards your child’s education (to reduce the need for a student loan).

- Build wealth through investments and give generously.

Conclusion: the debt snowball method works!

For many people, paying off their debts from smallest to largest is a motivating and rewarding experience, that keeps them on track to become debt-free!

Frequently Asked Questions

What if I have a credit card on 0% interest?

The debt snowball method involves paying off your debt from the smallest debt to the largest, regardless of the interest rate, while you make the minimum payment on your other accounts. That means even if your smallest debt has a 0% interest rate and the largest debt has the highest interest rate, you’ll start with your smallest debt firsts while making minimum payments on the others.

What is the debt avalanche method?

The avalanche method involves first paying off your high-interest debt, before you pay off lower interest debt. You start with your debt account with the highest rate of interest and pay the min monthly payment on any other debt accounts.

Do I include my mortgage in my debt snowball?

Dave Ramsey recommends focussing on your consumer debt such as credit cards and personal loans in your debt snowball and then moving to repay your mortgage once you have saved up three to six months of your household expenses. The rationale is because your mortgage tends to be your largest debt, so it can take a long time to pay off. If you waited until you had fully paid off your home to start investing, then you could potentially miss out on years of compound interest.

Why is repaying debt important?

Becoming debt-free is important to many people because it enables you to have much more freedom in how you live. Debt often chains you to a particular career and earning a certain amount of money. Once you have repaid your financial obligations you may have more freedom to work in a way that you enjoy; perhaps you can work fewer hours, or focus on a side hustle that earns money, or have the option to travel as you work.

Why do I only make the minimum payments on my other debt?

It’s important to make the minimum payments every month toward you other accounts, but no extra. This approach enables you to make real progress in repaying your smallest debt off in its entirety first, rather than making slow progress paying off a little of every single debt you have. The motivation you’ll feel once you pay off that first debt will spur you on to pay off the next smallest and then the next smallest.

What do you think about the debt snowball method?

We’d love to read your comments below and answer any questions.

If you enjoyed this article, you might enjoy these related articles:

Best Way to Pay off Credit Card Debt

From what I know, the debt snowball method is a debt-reduction strategy, whereby one who owes on more than one account pays off the accounts starting with the smallest balances first, while paying the minimum payment on larger debts. Although this system is very helpful, it’s not that common. Thanks for this informative article!

Hi Nelson, yes you have described the debt snowball method well! If you enjoyed this article you might also find these blogs helpful:

Best Way To Pay Off Credit Card Debt

How to Pay off Debt Quickly: Top Tips

Great article

Paying off the small ones first is good for morale but I would try and tackle the ones which are charging me too much interest first

Maybe do a bit of both approaches

Thanks for sharing your opinions, Liam! Yes, the best approach to paying off debt is the one that you will find most motivating and easiest to stick to.

The snowball method if a good way to get back in control of my debts. The plan is straightforward and offers some rewards along pretty quick. The hardest part of the discipline is to not overspend on your daily expenses, and get back that debt that you have paid off.

Reading articles about how to stay on the debt-free path is helpful in helping and encouraging others to stay with the plan and push forward. The idea of budgeting money is often foreign to some. Having a plan for spending your money is a great tool, and can be such a great practice and help keep your financial world on track. Having a good spending plan is one of the best things you can do for yourself while you are paying off your debt. Sami

Hi Sami, thanks for taking the time to comment. I’m so pleased to hear that you enjoyed this article! You mentioned that you enjoy reading articles about becoming debt-free. Here are some more free resources that you may find helpful:

Best Way To Pay Off Credit Card Debt

How to Pay off Debt Quickly: Top Tips

Thank you for your post. It is useful for me. I have so many different debts and need to use some effective ways to reduce my debts.

I particularly like your description on the benefits of the debt snowball method. It works because you receive a motivational boost every time that your off a debt in full. It also helps to see that people tend to see more success with the debt snowball method than other ones since it is easier to stick with the plan, which is the problem with me. I will definitely give this a try.

Hello Anthony, it’s great to connect with you. I’m really pleased that this article helped you. It can be scary when you are in a lot of debt, but you’ve already done the hardest part, which is recognising that you have an issue and taking action. This article will also help: How to Pay off Debt Quickly: Top Tips

I wish you every success on your debt-free journey.

I think the debt snowball method is better than the debt avalanche method to repay debts. simply because the former will be more motivating. We do things in baby steps so as we clear the consumer debts first which are smaller, we will feel more at ease. Discipline is important.

Thanks for taking the time to share your thoughts Richard!